Vidal Ibarra-Puig [1]

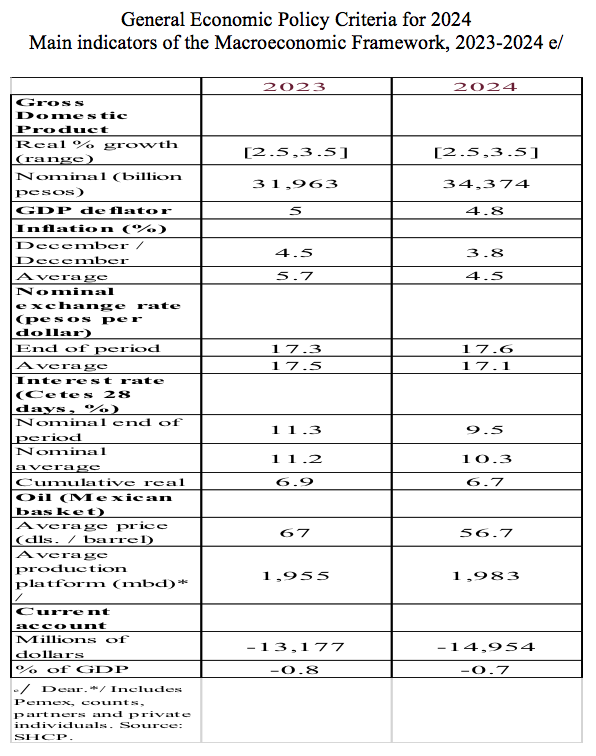

An anecdote tells that, at a certain point, Ernesto Zedillo’s transition team reproached the outgoing Salinas team, that «they had left the economy on pins,» to which the Salinas team responded: “Yes, but you took them away.» I remember this anecdote now that I have been reviewing the General Economic Policy Criteria for 2024, which the Secretary of Finance sent to the Chamber of Deputies in Mexico, and whose main macroeconomic indicators can be seen in the following table.

I distinguish here four pins: 1. Inflation of 3.8 by 2024. 2. Exchange rate of 17.6 pesos per dollar at the end of 2024. 3. Nominal interest rate, 28-day Cetes, by the end of next year of 9.5. 4. Average price of the Mexican oil basket at the end of 2024 of 56.7 dollars per barrel, with a production platform of 1,983 million barrels per day by the end of the same year.

Are these assumptions realistic? See.

First, we say that they are assumptions because, as far as we know, there is no well-founded econometric model to support these elements.

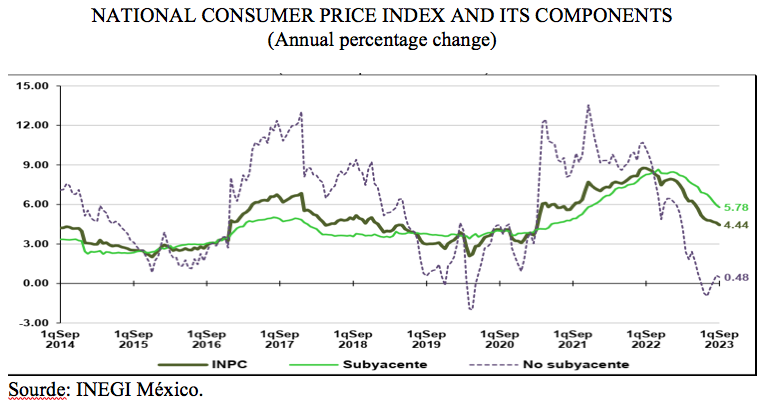

Now then. Regarding the first pin, the inflation forecasts at 3.8 for next year, the following graph illustrates what inflation has been since 2014.

Note that inflation in Mexico began in 2021, long before Russia’s war with Ukraine, which the authorities said was behind the increase in prices in our country; but that’s not the case. Inflation addresses domestic problems that have not been resolved, such as the low supply of agricultural goods, which have seen their imports increase sharply to meet domestic demand. This increase in imports is what has made it possible to reduce the prices of agricultural goods, even threatening them in their production, since it is cheaper to buy, for example, apples from the United States than domestic apples; this is one of the consequences of “super peso”. Then, if we look at core inflation (Subyacente in Spanish), this core inflation is at the level of 5.78, and without addressing the internal problems, the assumption of 3.8 by the end of next year does not seem plausible to us.

The second pin says that the exchange rate will be 17.6 pesos per dollar at the end of next year. However, on Wednesday, September 27, the price was 17.70 pesos on sale, higher than the official estimate, after having been at 16.9 pesos per dollar. It should be taken into account that some investigations have pointed out the unclear or even illicit origin of the entry of so many dollars into Mexico, so it would not be surprising a decrease in these flows and consequently a rise in the price of the dollar in national currency; a devaluation, in other words.

The third pin is the nominal 28-day Cetes rate by the end of 2024, at 9.5 percent. See. As of September 26, this rate was at 11.05, but the determinants of the level of interest rates in Mexico are not only internal: economic activity in the US and its inflation, and therefore the US interest rate influence, among other things, the determination of Mexican rates. For example, a drop in US growth is expected in 2024, so a decrease in rates in the northern neighbor should not be ruled out to boost its economy and prevent it from falling into recession, which is positive for Mexican interest rates, as they would not be pressured upwards by this factor. But if inflation continues in the colossus of the north, rates will not fall, which will influence that Mexican rates will not be able to fall, since the resources of savers will seek greater profitability, and more certainly, in the US. And to avoid this outflow of capital, national rates must remain at high levels, to also cover the exchange risk if the Mexican currency is devalued. For its part, interest rates in the US, specifically the Fed rate (which is the interest rate that banks charge each other when they lend money), is at levels of 5.25 percent, which could rise if inflation in that country were to rise. In Mexico, an increase in inflation has an orthodox management, since it is thought that all inflation is caused by the excess of the circulating currency, but the current authorities of the central bank do not seem to understand that inflation also has other causes such as wage increases and therefore increased costs for entrepreneurs; and on the other hand, imported inflation. Therefore, if inflation increases in Mexico, and it does not seem that it will decrease significantly from our point of view, Cetes rates will remain high.

The fourth pin is that the average price of the Mexican oil basket at the end of 2024 is $ 56.7 per barrel, with a production platform of 1,983 million barrels per day by the end of the same year. The first part of this assertion seems to us a prudential, not too optimistic management of this variable. On the other hand, the crude production of Petróleos Mexicanos (Pemex) during July stood at 1 million 835,000 barrels per day, below the 1,983 million projected. The problem is that there is no way to increase Pemex’s production: the Dos Bocas refinery is far behind in its construction; and the worst thing is that the company has decided to reduce the budget that will be allocated to the maintenance of its assets by 2024, by cutting it almost in half of what was granted for this year of 2023, despite the risks involved for its proper functioning and the accidents it has suffered and that has cost it that its bonds are now classified as junk bonds (see our collaboration «Pemex sinks; their debt bonds are worse than junk bonds,» https://monitorfinanciero.com.mx/opinion/y-por-que-no/y-por-que-no-pemex-se-hunde-sus-bonos-de-deuda-son-peor-que-bonos-basura-vidal-ibarra-puig/, June 17, 2023; in Spanish).

What would happen to the national economy if any of these pins come off?

That will be the theme of our next collaboration.

[1] PhD in International Economic Relations from Sciences Po, Paris; Professor in the Department of Economics, UAM Azcapotzalco, [email protected]